However, short-term holdings of small cap stocks may even result in losses-due to high market risk Market Risk Market risk is the risk that an investor faces due to the decrease in the market value of a financial product that affects the whole market and is not limited to a particular economic commodity.

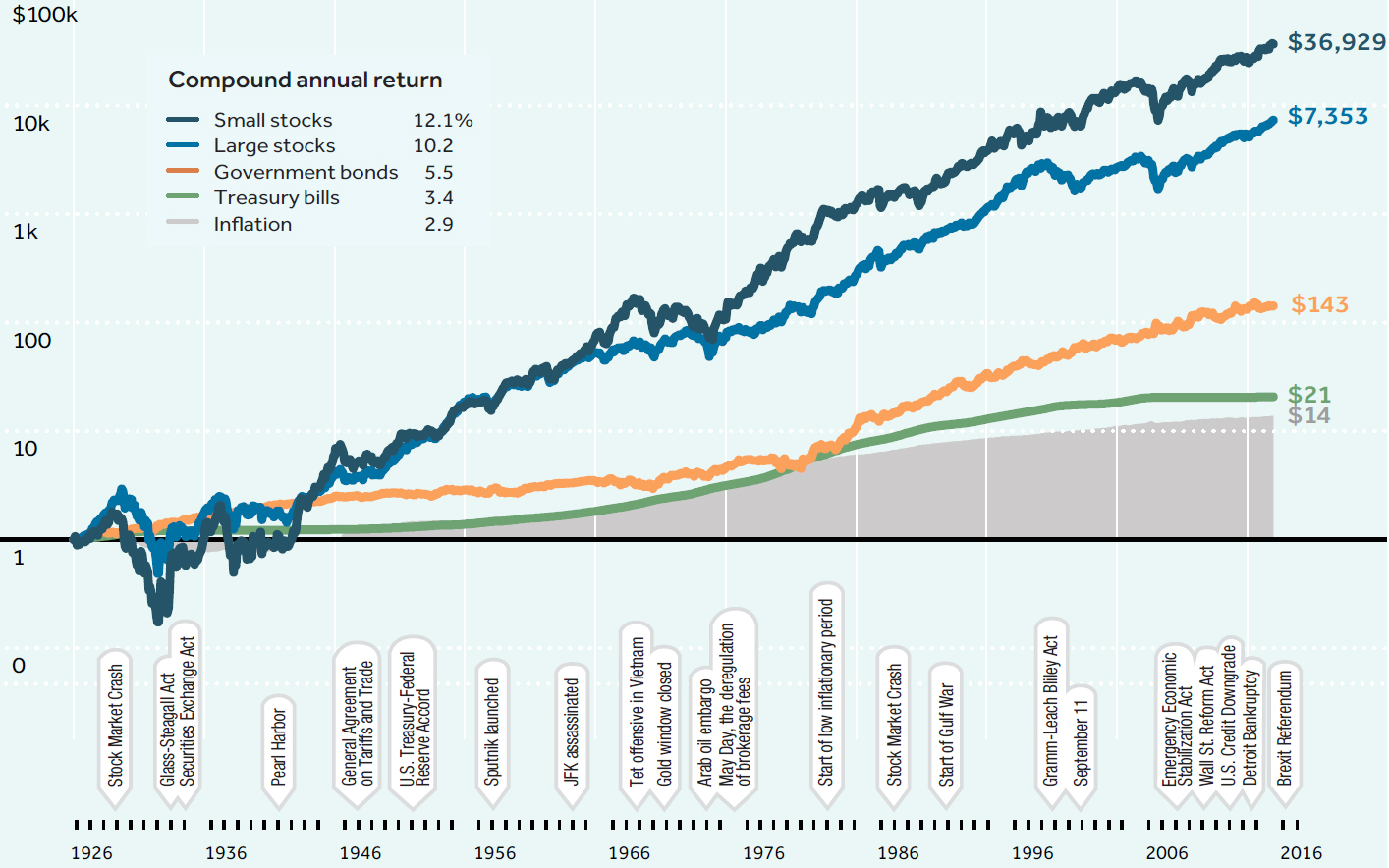

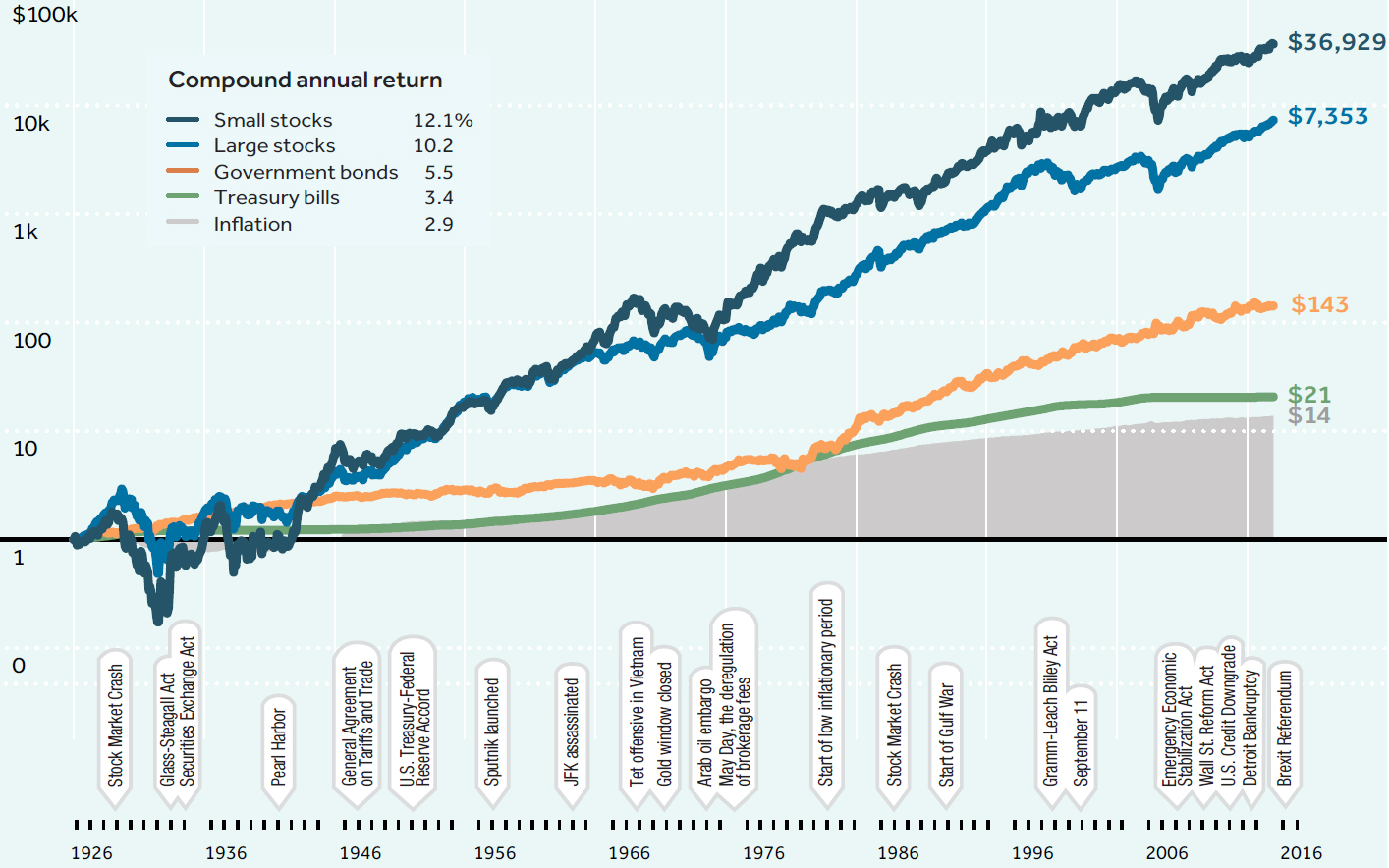

Long-term Perspective: They offer positive returns in the long run. High Return: These investments have the potential to generate huge profits in favorable market conditions. High Risk: Small companies are very sensitive to market fluctuations. Low Price: Due to low market capitalization, the price of these stocks are usually low, and therefore affordable for small investors. The following characteristics distinguish these stocks from other investment instruments: Even then, small cap risks cannot be overlooked-many fail miserably and become bankrupt. Investment diversification leads to a healthy portfolio. This way, the risk is kept to a minimal while the investor accumulates many assets. In a favorable market, portfolio diversification Portfolio Diversification Portfolio diversification refers to the practice of investing in a different assets in order to maximize returns while minimizing risk. read more with small cap options to spread the uncertainty. Their capital lies between that of large and small cap companies and valuation of the entire share holdings of these companies range between $2 billion to $8 billion. Therefore, investors diversify their portfolios by combining large-cap and mid-cap stocks Mid-cap Stocks Mid-Cap stocks are the stocks of the companies having medium market capitalization. Holding small cap equity in isolation is too risky. It is known to exceed the performance of the S&P 500-five hundred large-cap public companies in the US. The Russell 2000 is a small cap index that replicates the performance of two thousand small cap stocks in the US. read more of small cap companies ranges between $300 million and $2 billion.

It is computed as the product of the total number of outstanding shares and the price of each share.

The market capitalization Market Capitalization Market capitalization is the market value of a company’s outstanding shares. Newly established businesses with massive growth potential are called small cap companies. read more, it is referred to as a small cap stock. It is the difference between the assets and liabilities shown on a company's balance sheet.

When a small cap company trades equity Equity Equity refers to investor’s ownership of a company representing the amount they would receive after liquidating assets and paying off the liabilities and debts.

0 kommentar(er)

0 kommentar(er)